Roth ira penalty calculator

Rules for Inheriting a Roth IRA. Direct contributions can be withdrawn tax-free and penalty-free anytime.

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

You reach age 59½ suffer a disability make.

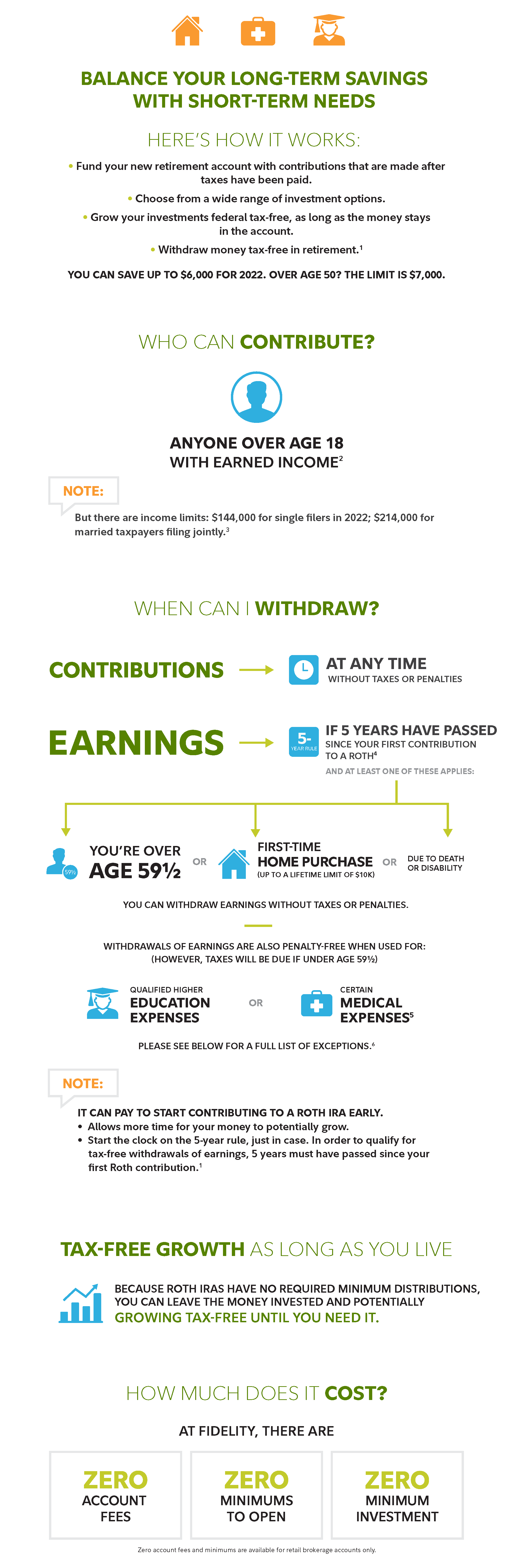

. If you inherit a Roth IRA as a spouse you can withdraw any or all of the account tax-free provided the account has existed for at least five years. The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. 401k Withdrawing money from a 401k early comes with a 10 penalty.

401k traditional IRA or Roth IRA. Your income also cant exceed the Roth IRA income limitsIn 2022 youre ineligible to contribute if your income is greater than 144000 for single filers and 214000 for married couples filing a joint return. In this case you will not be charged the 10 early withdrawal penalty.

And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from. To be considered a qualified distribution the 5-year aging requirement has to be satisfied and you must be age 59 ½ or older or meet one of several exemptions disability qualified. If your Roth IRA account isnt at least five years old or if youre not yet 59½ the earnings portion of any withdrawal may be subject to taxes and a 10 penalty.

Calculate your Roth IRA basis by adding up all your contributions and subtracting any distributions youve made. How to Withdraw From a Roth IRA Early Penalty-Free. So for example if youre both 50 or older during the calendar year as long as your spouse has 14000 in compensation and you and your spouse do not exceed the MAGI limits your spouse could contribute up to 7000 annually to a Roth IRA in his or her name and up to 7000 annually to a Roth IRA in your name.

To fund a Roth IRA you need earned income which is money you earn through a job or self-employment. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty. With a Traditional IRA you contribute pre- or after-tax dollars your money grows tax-deferred and withdrawals are taxed as current income after age 59½.

Estimate your tax refund and where you stand Get started. Calculating Roth IRA basis helps distinguish between your contributions and growth of that money in your Roth account. This limit applies across all IRAs.

Withdrawals must be taken after age 59½. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you. A distribution from a Roth IRA is tax-free and penalty-free provided that the 5-year aging requirement has been satisfied and at least one of the following conditions is met.

The five-year count starts with your first contribution to the account. Withdraw up to a 10000 lifetime cap for a. Backdoor Roth IRA conversions let you circumvent the limits in the table above.

As soon as those 60 days are up the money from the IRA is considered to be cashed out. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. A Roth IRA basis is the total amount of money youve contributed to your Roth IRA since opening the account.

A qualified distribution from a Roth IRA is tax-free and penalty-free. Converted a traditional IRA to the Roth IRA. Rolled over a Roth 401k or Roth 403b to the Roth IRA.

Ages younger than 59 ½ with a Roth IRA youve had more than five years you can avoid the penalty for early withdrawal and taxes on earnings if you. A backdoor Roth IRA works like this. You open a new traditional IRA make non-deductible contributions to it then.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. 2 Alsothere are penalties for withdrawing. While Roth IRAs are not intended to be a savings account Roth IRAs do allow you to withdraw funds without the 10 early withdrawal penalty.

If you pay an IRS or state penalty or interest. In general youre allowed to withdraw Roth IRA contributions and earnings without being taxed or penalized. Withdrawals must be taken after a five-year holding period.

When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after. If youre under age 59½ and you have one Roth IRA that holds proceeds from multiple conversions youre required to keep track of the 5-year holding period for each conversion separately.

A Roth IRA and a 401k are two types of retirement accounts with one big difference in how they are taxed. Beginning at age 72 you must start withdrawing a certain amount of your savings each year or youll pay a penalty. If youd rather not take the Roth IRA as a lump sum you have options.

Likewise you must pay income taxes on early withdrawals of earnings from a Roth IRA and you might owe a 10 IRS penalty as well. First contributed directly to the Roth IRA. Retirement Calculator Investment Calculator Net Worth Calculator.

With a Roth IRA you contribute after-tax dollars your money grows tax-free and you can generally make tax- and penalty-free withdrawals after age 59½.

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Pinterest

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Traditional Vs Roth Ira Calculator

Save For The Future With A Roth Ira Fidelity

What Is The Best Roth Ira Calculator District Capital Management

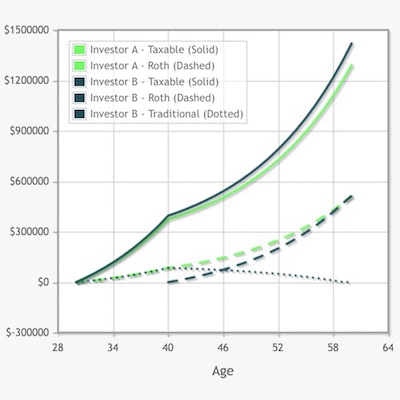

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Traditional Ira Definition Rules And Options Nerdwallet

Pin On Financial Independence App

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal